Digital Wallet Security Top Features to Protect Your Money – 2024 Guide

Digital wallets have become a popular way to pay, offering convenience and speed. But with this ease of use comes the natural concern: is my money safe in a digital wallet?

The good news is that digital wallets generally employ robust security measures, often exceeding the security of traditional methods like physical cards. However, it’s crucial to understand how these features work and choose a wallet with the best protection available.

Are Digital Wallets Safe?

Yes, when used with trustworthy providers that prioritize security, digital wallets can be highly secure. They use advanced technologies like tokenization, encryption, and multi-factor authentication to reduce the risk of fraud and financial loss.

What Security Features Should I Look For In A Digital Wallet?

Tokenisation: This technology replaces your actual credit or debit card number with a unique token during transactions. Even if a merchant experiences a data breach, hackers won’t obtain your real card details.

Encryption: Digital wallets encrypt sensitive data like your card information, making it unreadable to unauthorized individuals.

Multi-Factor Authentication: This adds an extra layer of security by requiring a second factor, like a PIN, fingerprint, or facial recognition, beyond your password for login and transactions.

Device Security: Reputable digital wallets leverage your phone’s built-in security features, such as fingerprint scanners and secure lock screens, for additional protection.

Transaction Monitoring: Many wallets offer real-time transaction monitoring and alerts, notifying you of suspicious activity immediately.

Biometric Authentication: Advanced wallets utilize fingerprint, facial recognition, or iris scanning technology for secure login and transaction confirmation.

Secure Enclaves: Sensitive data can be stored within a secure enclave, a hardware-based isolated environment within your device, further protecting it from unauthorized access.

Data Loss Prevention: DLP solutions can prevent sensitive data from being accidentally shared or leaked outside the digital wallet app.

Secure Communication Protocols: Secure protocols like HTTPS ensure encrypted communication between your device and the wallet provider’s servers.

Regular Security Audits: Reputable digital wallet providers conduct regular security audits by independent experts to identify and address potential vulnerabilities.

How Do Choose A Digital Wallet That Fits My Needs?

1. Reputation: Opt for established and trusted providers with a proven track record of security practices.

2. Security Features: Ensure the wallet offers tokenization, encryption, MFA, biometric authentication, and other advanced security features.

3. Reviews and Ratings: Research user reviews and ratings to gain insights into the wallet’s security and user experience.

4. Regular Updates: Choose a wallet that prioritizes regular security updates and bug fixes.

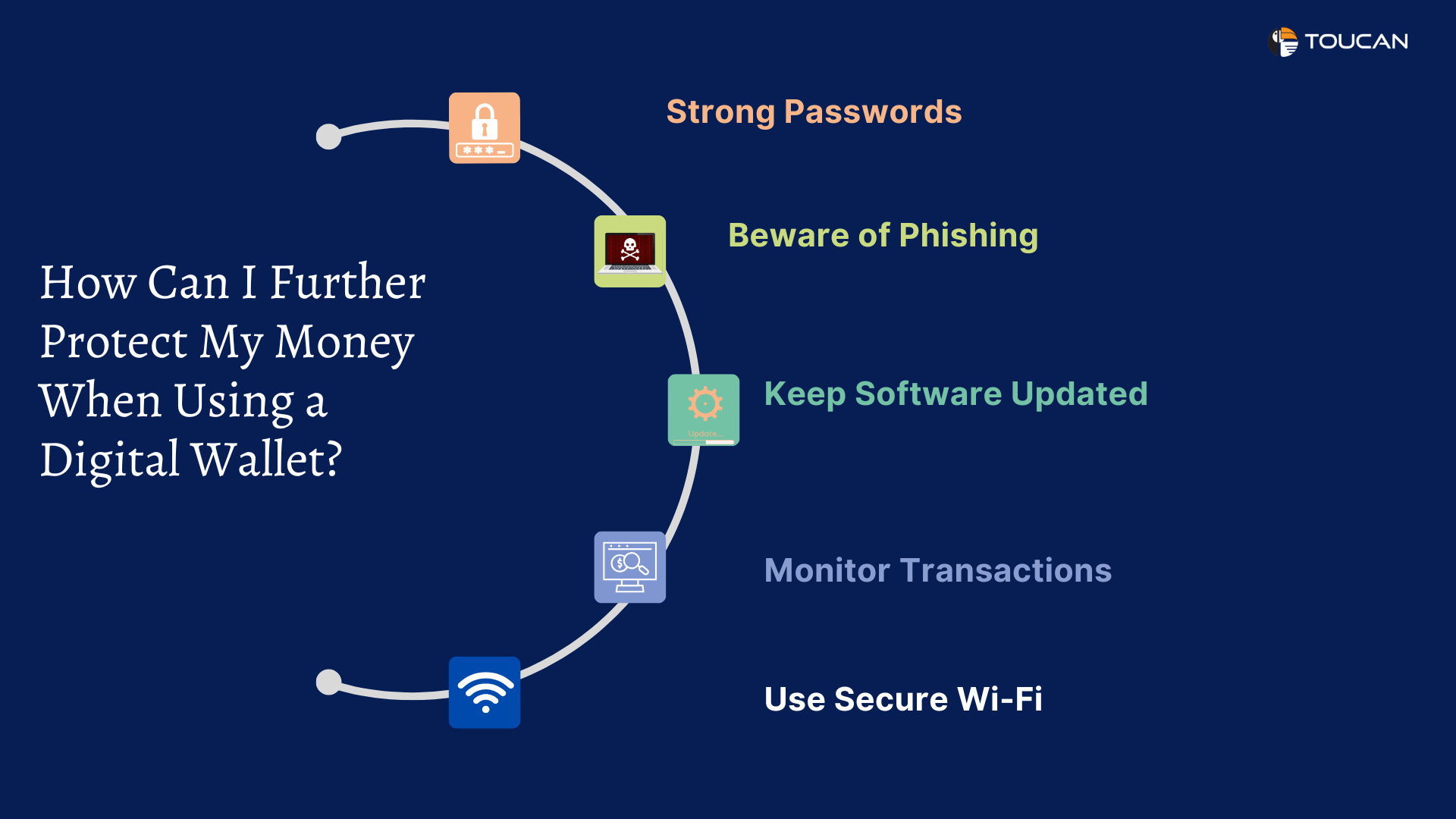

How Can I Further Protect My Money When Using a Digital Wallet?

- Strong Passwords: Use strong, unique passwords for your digital wallet and avoid using the same password for other accounts.

- Beware of Phishing: Never share your digital wallet credentials or personal information through suspicious emails, texts, or websites.

- Keep Software Updated: Maintain the latest software updates on your device and the digital wallet app itself.

- Monitor Transactions: Regularly review your transaction history for any unauthorized activity.

- Use Secure Wi-Fi: Avoid using public Wi-Fi networks for sensitive transactions on your digital wallet.

Final Thoughts

As the digital world continues to evolve, so do the security measures needed to safeguard it. Staying informed and choosing a digital wallet with top-tier security features not only protects your assets but also strengthens the overall digital economy.

For businesses looking to deploy a secure and advanced digital wallet, Toucan offers cutting-edge solutions designed to exceed industry standards. Our platform is built with security at its core, ensuring seamless and protected transactions for users.

Discover the advanced security features of Toucan’s Digital Wallet today!